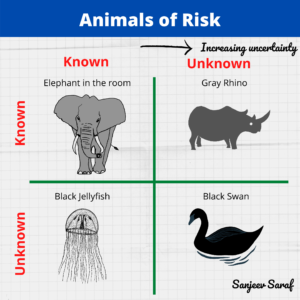

Mergers and Acquisitions (M&A) are a part of today’s corporate growth strategy. As a part of M&A due diligence various critical business issues are evaluated. But what about safety performance of the company you are looking to acquire or merge with?

You will say that most M&A in oil and gas/chemical processing industries are asset-driven. You look at what the pots and pans can do for you in the future and base your M&A decision.

Remember as a part of M&A you are also acquiring the liabilities. You may recall liabilities incurred by Union Carbide after the Bhopal tragedy.

Past liabilities may be easier to identify; however, you may incur significant costs from a safety incident in the future that may affect your sustainability and profitability.

It is therefore only prudent to evaluate risk exposure prior to M&A, particularly if,

- Your organization has never been involved in chemical processing / oil and gas operations and you are looking to acquire a chemical processing operation

- You are looking to acquire pots and pans that utilize manufacturing processes and technologies significantly different than your current operations

In future posts, I will discuss what to look for as a part of safety due diligence prior to M&A.

4 Responses

Hello Sanjeev,

“[…] You will say that most M&A in oil and gas/chemical processing industries are asset-driven. You look at what the pots and pans can do for you in the future and base your M&A decision”

Why are you so convinced that an M&A decision is mainly asset-driven?

Regards,

Cantemir

Hi Cantemir…what I meant is that most mergers in processing sectors are operational units and their valuation is based on performing assets. This is different in software (look at youtube acquisition) or valuation of twitter.

But now that you point out I probably should not have used such a general statement