For the month of September, I thought it would be appropriate to write a post on Terrorism Risks.

Since 2001, there have been an average of 5 attempted terror attacks annually in the U.S. that have resulted in arrests, trial, or raising of the DHS threat level. Now you know what changes the threat level at the airport.

Here is an interesting paper from Risk Management Solutions (RMS) about predicting terror attacks.

The report talks about modeling to prioritize terror targets and identify likely targets. For example, government buildings would be an attractive target. Similarly, big populated cities such as New York would be an attractive terror target compared to Bangor, Michigan (where’s that?).

What is of interest from such modeling is an estimate of exposure for terrorism insurance coverage. So I’m not sure the best way to approach this is theoretical modeling.

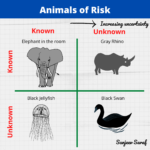

Statistical modeling can probably help us understand some trends; however, as we have seen the major terror attacks (9/11, London bombing, Bombay’s Taj hotel incident) are almost always outliers.

This is where risk modelers can take a leaf out of Hollywood. For example, look at the evolution of threats in the Die Hard series. It goes from guns and bombs to a fire sale.

What’s a fire sale? “It’s a three-step systematic attack on the entire national infrastructure. Okay, step one: take out all the transportation. Step two: the financial base and telecoms. Step three: You get rid of all the utilities. Gas, water, electric, nuclear. Pretty much anything that’s run by computers which… which today is almost everything. So that’s why they call it a fire sale, because everything must go.”

OK…fire sale may be a bit too extreme. But it is conceivable that the next attack(s) may be on infrastructure – oil and gas pipelines, water, electricity lines. As I have written before, these assets are the ones that are more vulnerable.

My recommendation would be to use a brainstorming approach coupled with available statistical data to characterize terror risks.